highest and best use analysis

CUSPAP highest and best use. The four criteria the highest and best use must meet are legal permissibility physical possibility financial feasibility and maximum productivity.

Definitions And Info Flashcards Quizlet

The conclusion of highest and best use HABU is an important consideration in each intangible asset analysis.

. The HABU conclusion can affect the quantitative result of a. To assess the highest and best use value analysis for a property requires extensive knowledge of the market area potential market growth zoning and property type. A highest and best use analysis can be either completed within an appraisal or as a stand-alone assignment.

The reasonably probable and legal use of property that is physically possible appropriately supported and financially feasible. The Appraisal Journal January 7 2021 0830 AM CHICAGO Jan. Highest and Best Use The Highest and Best Use of a property refers to the.

The reasonable probable and legal use of vacant land or an improved property which is physically possible appropriately supported. Alternatively the probable use of land or. HIGHEST AND BEST USE EXAMPLE Highest and best use is defined by Real Estate Appraisal Terminology as follows.

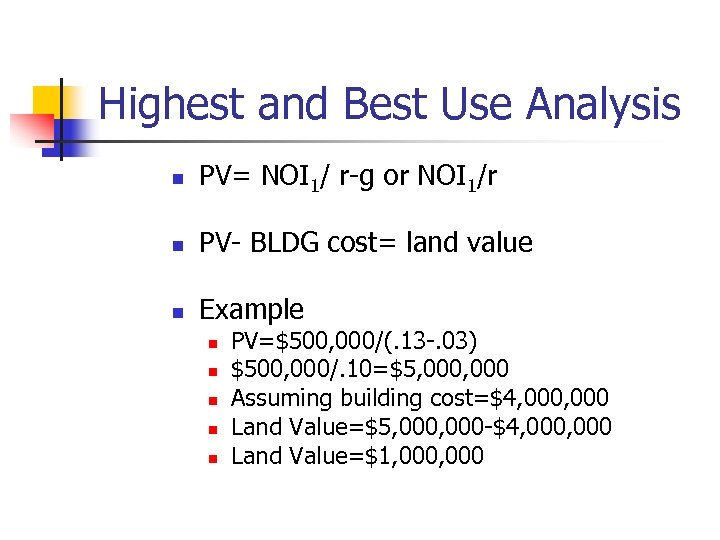

This is particularly important for vacant land and areas that are transitioning to other uses such as changing from homes to conversion to commercial uses. The definition of highest and best use is as follows. Steps in Highest and Best Use Analysis Determine Use With Highest Present Value.

Highest and Best Use or highest or best use is a concept that originated with early economists such as Irving Fisher who conceptualized the idea of maximum productivity. Inspect the subject property and adjacent properties. Highest and Best Use Analysis is an approach to investment analysis which determines the use or mix of uses that are likely to produce the greatest net return to a property.

The four tests of highest and best use are. Conduct a Highest and Best Use Analysis that covers the following steps. Collect and analyze legal and technical documentation.

The conclusion of highest and best use HABU is an important consideration in each intangible asset analysis. Highest and Best Use Example. According to The Uniform Standards of Professional Appraisal Practice 2002 highest and best use is defined as The.

1 legally permissible 2. That reasonable and probable use that supports the highest present. 7 2021 The.

How To Determine The Highest And Best Use Of A Property Propertymetrics

Residential Market Analysis And Highest Best Use Flashcards Quizlet

Highest And Best Use Analysis Pdf Real Estate Appraisal Urban

Focus On Real Estate Analysis Comments On The Concept And Definition Of Highest And Best Use Semantic Scholar

Ultimate Guide To Highest And Best Use Analysis Feasibility Pro

Ultimate Guide To Highest And Best Use Analysis Feasibility Pro

Highest And Best Use Is An Archaic Concept Panethos

Amazon Com Market Analysis For Real Estate Concepts And Application In Valuation And Highest And Best Use 9780922154869 Fanning Stephen F Books

Property Sustainable Value Versus Highest And Best Use Analyzes Walacik 2020 Sustainable Development Wiley Online Library

Amazon Com General Market Analysis And Highest And Best Use Appraisal Essentials 9780840049254 Munizzo Mark A Musial Lisa Virruso Books

Valuation Of Income Properties Appraisal And The Market

1 The Valuation Process Diagram Quizlet

Market Analysis Highest And Best Use 2nd Edition Timothy Detty 9781598441680 Amazon Com Books

How To Determine The Highest And Best Use Of A Property Propertymetrics

Residential Reporting Hitting All Of The Bases 1 Hondros Learning C 2011 Effective Writing And Reasoning Skills In Appraisal Reporting Chapter Ppt Download

Highest Best Use Analysis Studies And Services Colorado Appraisal Consultants

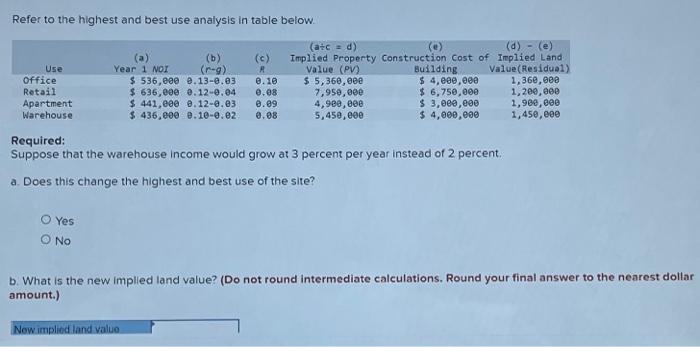

Solved Refer To The Highest And Best Use Analysis In Table Chegg Com